Written by the Mackenzie Fixed Income Team

Key Highlights

- Fed officials continue to look for more evidence that inflation is sustainably on a downward trend, and stronger data led to market recalibrating 2024 rate cut expectations.

- We continue to believe inflation trending lower and weaker labor markets in Canada might lead to divergence in monetary policy actions for BoC versus the U.S Fed.

- We see opportunities to add during rate sell-offs in Canada where demand is slowing, interest rate sensitivity is high.

- Globally, falling inflation and weaker wage growth data keeps Euro rates in favor while in Japan, we are less sure for a material rise in JGB yields as we believe the hiking cycle, if materialized, would be quite slow.

- With the prospect of a dovish Fed looming in the months ahead, emerging markets with key exposures to the US economy should perform well.

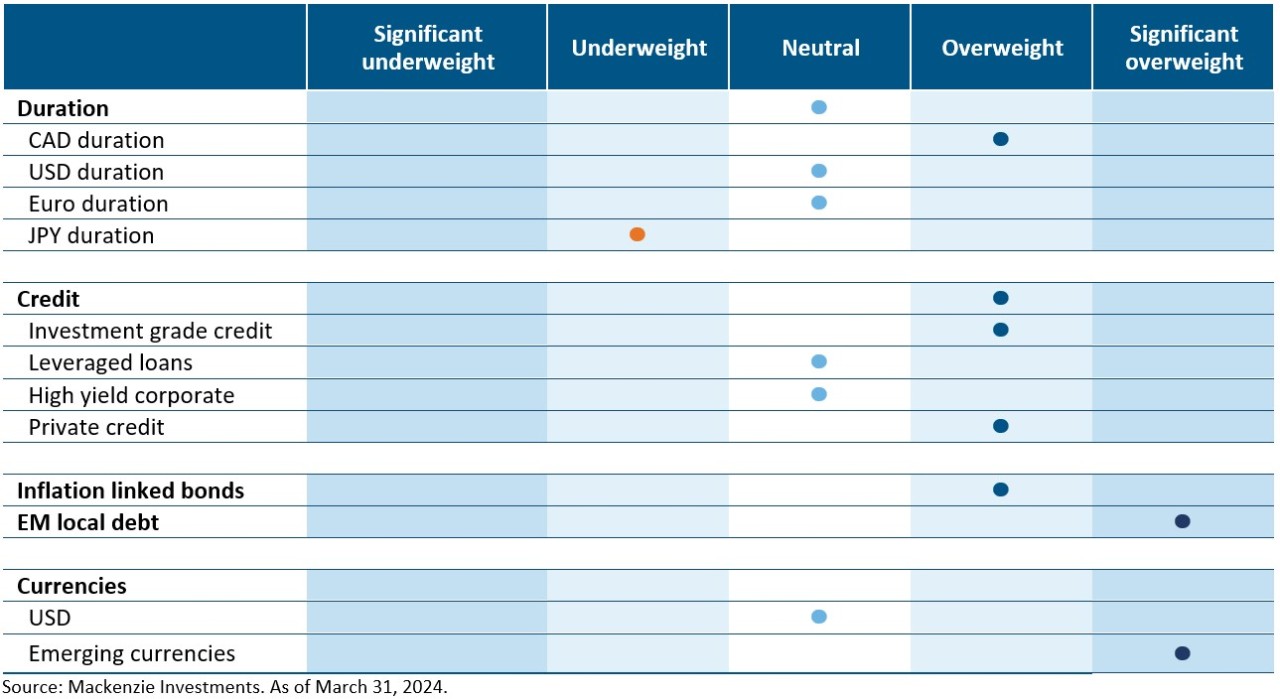

Fixed Income Team Views

Central Bank Watch

The US Fed (Fed)

Inflation in the US remained elevated at 3.2% y/y in Feb’24, while the Fed’s preferred inflation gauge, Core PCE which strips out the volatile food and energy components, rose 2.8% y/y in Feb’24. Elevated inflation and a strong labor market have led to market recalibrating rate cut expectations in 2024. While the Fed hold in its policy meeting was certainly consensus, many questioned the sentiment of Chairman Powell following a series of hotter than expected CPI prints. Fed officials continue to look for more evidence that inflation is sustainably on a downward trend, and in the meantime, not rushing to cut interest rates.

The Bank of Canada (BoC)

The headline inflation eased to 2.8% in February, primarily driven by moderating goods price inflation while shelter costs continue to exert upward pressure. Underlying inflationary forces persist, with core inflation measures hovering near 3%. Bank maintained policy rate at 5% underscoring its cautious approach as they continue to remain vigilant about the persistence of underlying inflation. We continue to believe inflation trending lower and weaker labor markets might lead to policy rate action divergence for BoC versus the Fed.

The European Central Bank (ECB)

Consumer prices rose higher than anticipated at 2.6% y/y in Feb’24, however policymakers remain optimistic for inflation to continue disinflationary process towards their 2% goal. Wage growth continued to cool in the euro area to 4.6% in 4Q23 from 5.1% in 3Q23, moving in the right direction for the ECB to lower interest rates. Lagarde's ECB is seen as independent and possibly willing to act more assertively than waiting for Fed cues. We believe ECB to out dove the Fed and favour Euro duration exposure particularly in our global mandates.

The Bank of Japan (BoJ)

The BoJ hiked its key policy rate from -10bp to a new range of 0-10bp. While the BoJ also stopped its Yield Curve Control program, it’s JGB bond buying program is slated to remain at about the same pace. However, BoJ Governor Ueda’s dovish forward guidance, suggesting to some the BoJ might not hike for the rest of the year, is what in large part what the traded markets focused on. The market had been expecting another 25bp hike (to get the policy rate to 0.25%) sometime in Sep or Oct 2024, and that now looks to be somewhat in jeopardy.

Emerging Markets (EM)

In Latam, a strong inflation downtrend and high real ex-ante rates have allowed the region’s central banks to embark on rate cuts well before their DM counterparts. The central bank of Mexico begun their hiking cycle nearly a year in advance of developed market economies as the policy rates peaked at 11.25%. Inflation has responded favourably, enabling a policy pivot with the first rate cut enacted at the March meeting. With many emerging market peers having already entered an established easing cycle, Mexico looks primed to capitalize on the positive impact of future rate cuts.

Duration and Curve Positioning

The Fed’s increased tolerance and policy rate cut expectations have led to higher risk asset prices as we continue to see this narrative challenged by the inflation reports and activity data. We think that the Fed is starting to line up at every other meeting cadence beginning June but don't think this Fed really wants to go all the way to neutral. In Japan, we are less sure for a material rise in JGB yields in the months ahead, although we believe the hiking cycle, if materialized, would be quite slow. We see opportunities to add during rate sell-offs, especially in Canada where activity and aggregate demand are slowing, and interest rate sensitivity is high. With many emerging market peers having already entered an established easing cycle, Mexico looks primed to capitalize on the positive impact of future rate cuts. With the prospect of a dovish Fed looming in the months ahead, emerging markets with key exposures to the US economy should perform well.

Investment Grade Corporates (IG)

In March, the CAD IG Credit index delivered a total return of +0.6% and the US IG market delivered an impressive +1.2% of total return in March contributed by tighter spreads and lower yields. The IG spreads keep grinding tighter in the US and are now below 100bps, tightest they have been since the rate hike cycle in Mar’22 supported by stronger economic data and earnings. We prefer to be invested in high-quality corporate bonds at the front end of the Canadian curve over the US as a income and capital gain opportunity.

High Yield bonds (HY)

HY bonds provided solid returns in March as bond yields and spreads decreased 14bp and 12bp to 7.83% and 343bp amid a supportive earnings season, and remarks from Fed chair Powells comments that left little doubt about his intent to start cutting rates in the not-too-distant future. Meanwhile, CCC-rated bonds notably underperformed amid a few idiosyncratic credit situations. We continue to prefer the higher quality spectrum of the high yield space and are also finding attractive opportunities in other areas (LRCN/Hybrid) that we feel offer attractive risk-return characteristic and diversification for our mandates.

Leveraged loans (LL)

Greater investor demand and stronger economic activity data has propelled loan prices resulting in another strong gain for the asset class as investor appetite for risk is returning and volatility subsides. US leveraged loans delivered a return of 0.85% in March and 2.46% YTD in what remains an elevated rate environment. Elevated base rates kept quarterly loan returns atop 2% for six straight quarters. We reflect our neutral view on loans as we see a good opportunity to receive higher coupons & favour higher quality loans in the current economic cycle.

Bond stories

Investment Grade Bond – Mexico Local Currency Bonds

The team has invested in local currency bonds, granting exposure to the Mexican Peso. Gaining just shy of 3 percent relative to the Canadian dollar in March the peso continued its remarkable rally. The currency has proven to be a market favourite, bolstered by its attractive carry returns in the wake of aggressive tightening by the country’s central bank – Banxico, as interest rates remain elevated even following the first 25bp rate cut earlier this month. Supported by the relative credibility of Banxico relative to LATAM peers, improving growth prospects, and reduced volatility surrounding joint US and Mexican elections, we remain constructive on the Peso.

High Yield Bond – Source Energy

Source Energy Services is an integrated producer, supplier and distributor of frac sand, with a market leading position in the Western Canadian Sedimentary Basin. We’ve been a long-term supporter of the company, having initiated a position back in 2017. Our thesis was that the frac sand would have structural demand growth as the cheapest way to increase efficiency for oil and gas producers, and that Source’s leading position would allow it to dominate the market. The company faced some setbacks as the Oil and Gas bear market went on for much longer than most people expected, leading to several changes to its capital structure. However, we remained confident on the long-term thesis and negotiated very favourable terms including a large equity ownership position. Today, with the energy pricing much improved and production booming, Source Energy has rebounded from as low as 20 cents on the dollar to near par and is prime for a refinancing transaction. Given that we expect prevailing trends to continue, and that Source’s leading market position has only been further reinforced during the downcycle with many competitors fading away, we continue to be long both the credit and equity.

ESG – Embecta

Embecta is a global provider of insulin delivery products that generates more than $1 billion of revenue annually. The company has a 100-year legacy in insulin delivery to empower people with diabetes to live their best life through innovative solutions. Product sales are roughly 75% insulin pen needles which is a stable business, 15% insulin syringes which is a declining business, and 10% ancillary products that are used by patients with Type 1 and Type 2 diabetes. EMBC bonds look compelling going forward with a yield greater than 9% vs more than 8% for the high yield healthcare index and 7% for most high-quality healthcare names.

We consider EMBC to be best-in-class on ESG characteristics primarily because of the social good provided by their products. They recently released a 2024 ESG Strategy Report and highlighted that they are the #1 producer of diabetes injection devices with more than 8 billion units produced annually across three world-class facilities which translates into 30 million people living with diabetes reached annually, and more than 100 countries served by more than 2,000 employees.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of March 31, 2024, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.